Overview

I was recruited by WayWiser’s CTO to join a small, fast moving product team building a platform for families and paid professionals to provide better care for their aging loved ones.

The team had released a “public beta” with a very heavy focus on their mobile app and now were looking to enhance their user experience. The founder’s vision was to begin adding new functionality geared towards protecting older adults – and also help families get securely organized for caregiving, as well as estate planning.

DISCOVERY & RESEARCH

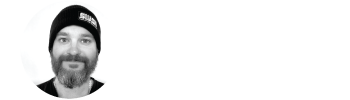

The product team had some existing feature designs and a small group of “friendly” users. We also had executive stakeholders and board members with a great deal of subject matter expertise and a powerful vision for creating transparency with regard to family finances. After getting up to speed on the in-flight work, the Director of Product and I kicked off a series of research activities – including interviews with users to review concepts, beta feedback sessions and the creation of user journeys & personas.

The findings from this research told our team that we needed to focus on engagement if we hoped to get adoption of the tool across groups of people – whether families or professionals.

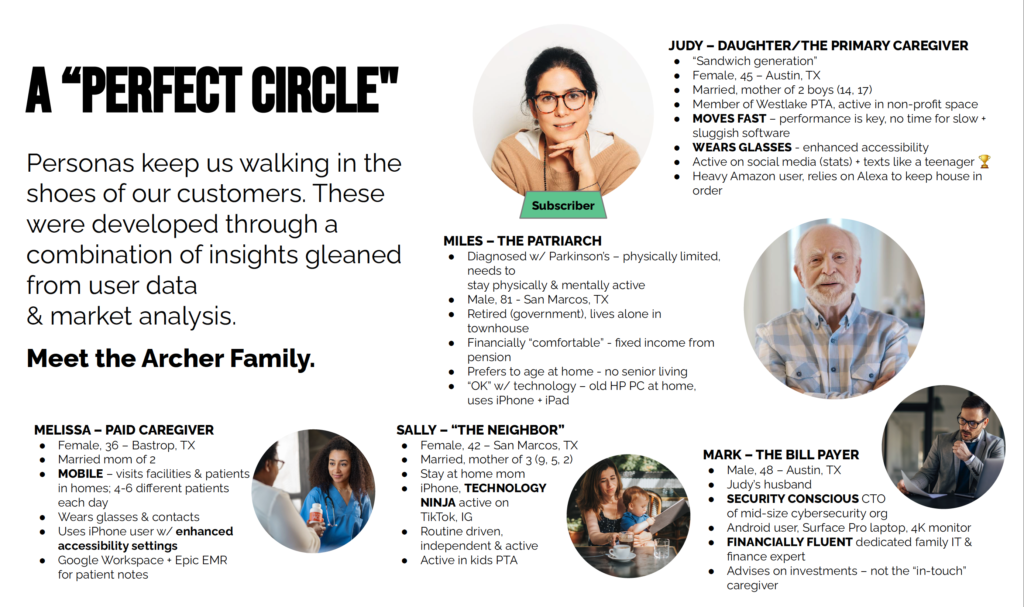

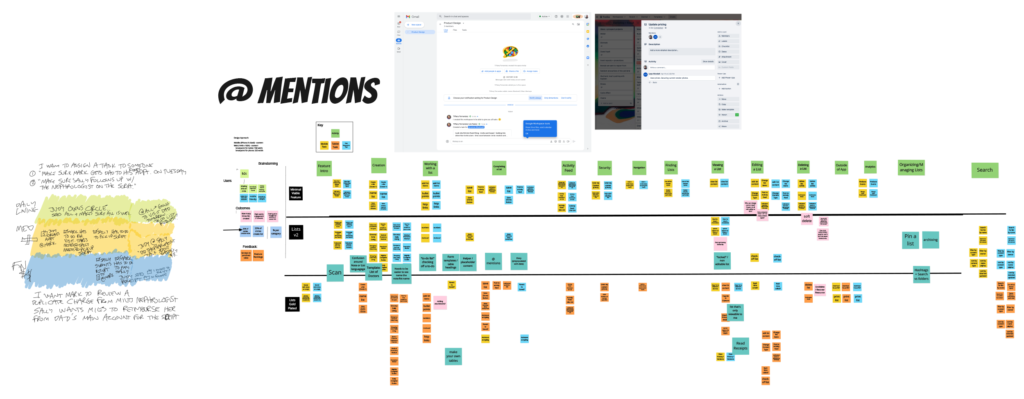

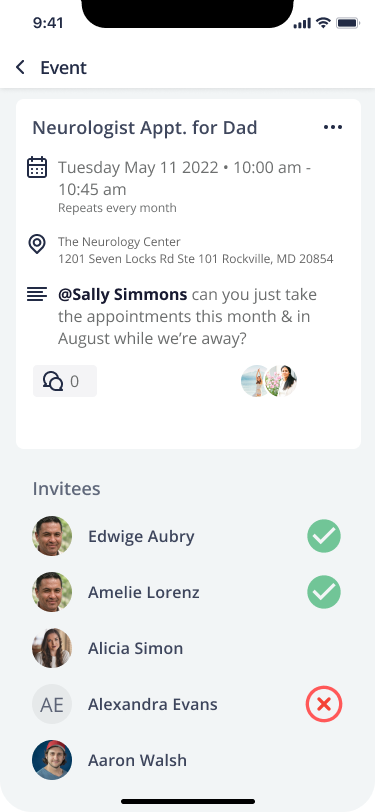

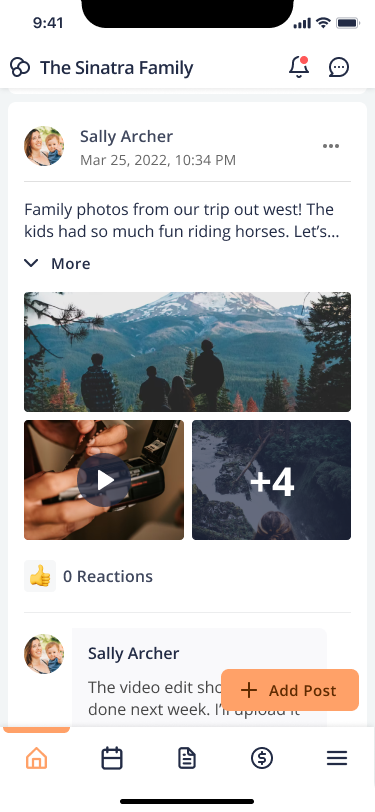

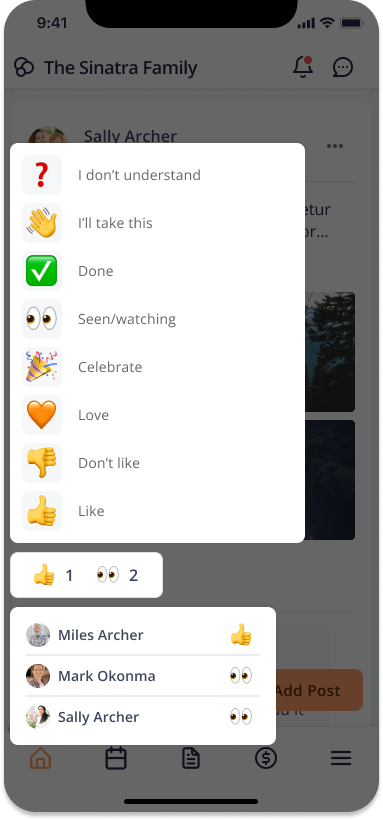

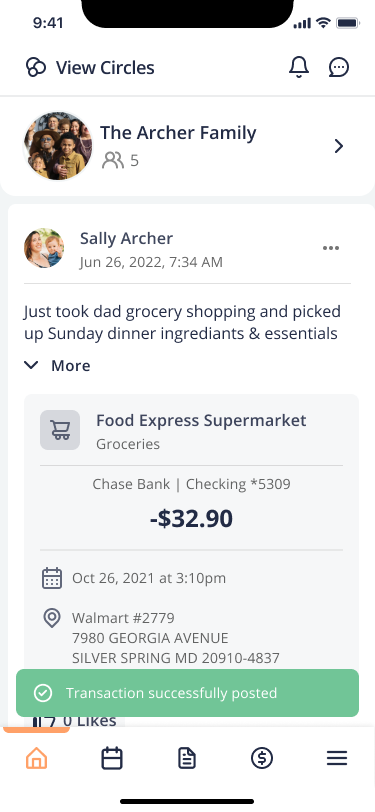

We already had an activity feed, shared calendar, shared notes and to-do lists. However, users told us they really wanted to be able to interact with other user’s content. So we added features allowing users to @Mention to tag others, and gave them more robust tools for interacting with each other’s content.

Design Work

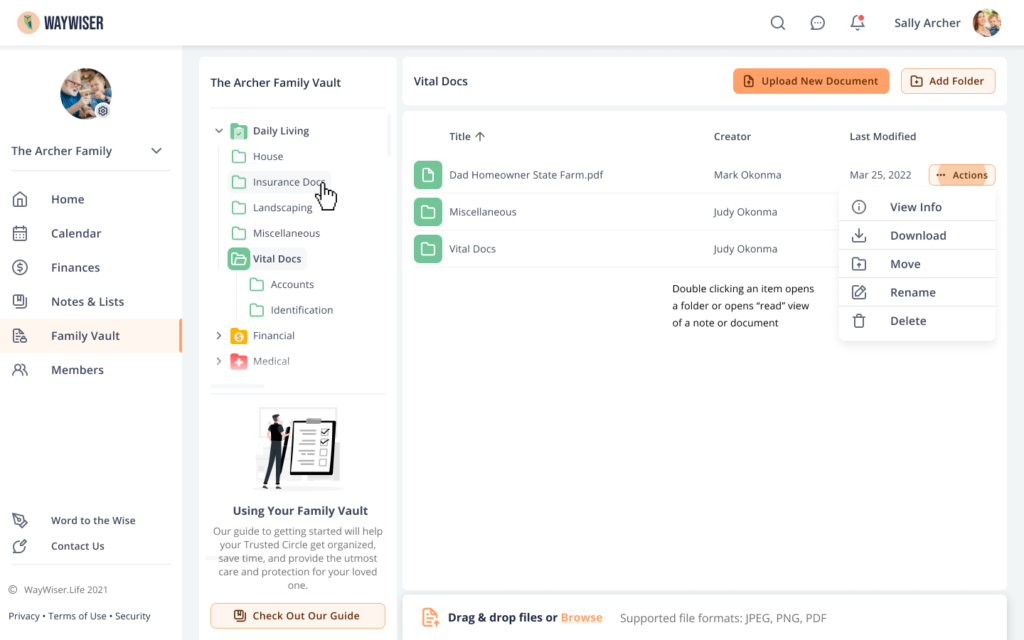

Family Vault Document Storage

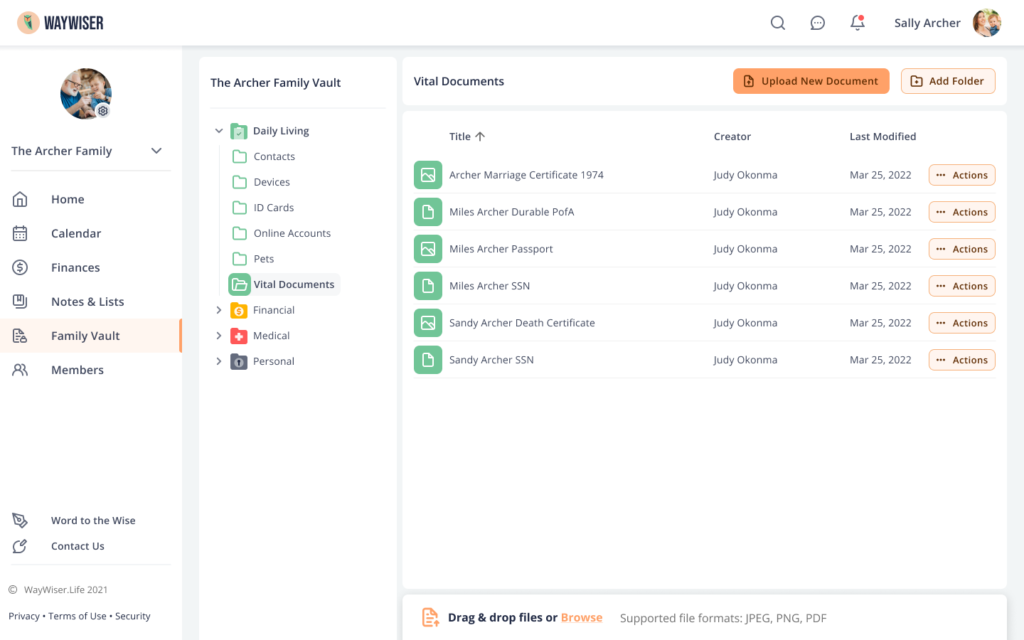

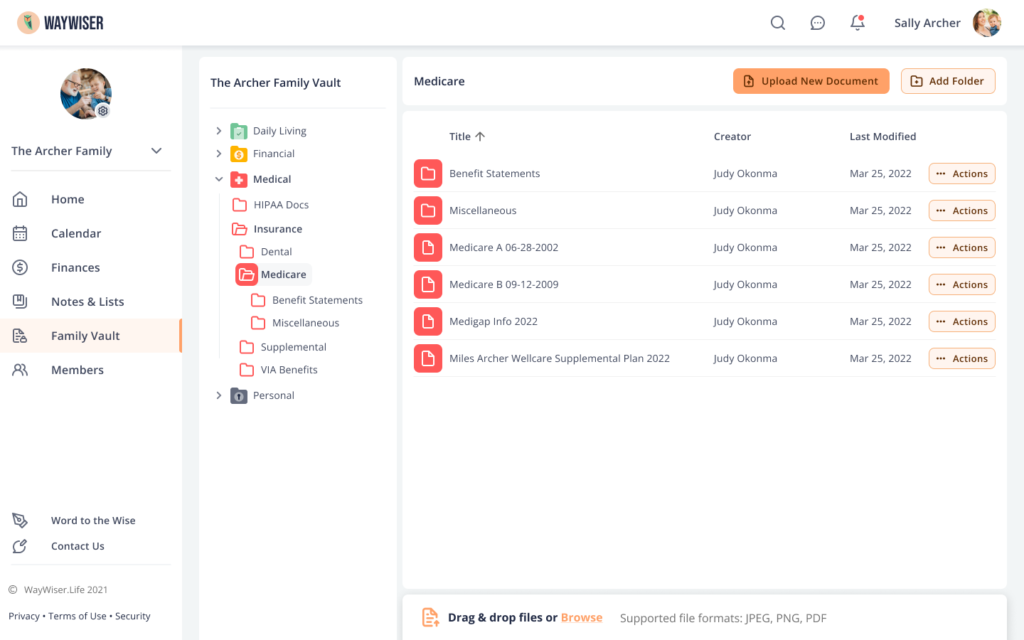

Much of the work we created at WayWiser was geared towards providing a simplified spin on existing, familiar tools. Our goal was to take the most important, essential pieces of proven tools that our users already leveraged – the Facebook Feed, Apple’s Notes app, Google Drive, etc. – and deliver an experience tailored to an older demographic.

This was the guiding philosophy behind our MVP document storage solution, branded the “Family Vault.” It provides families with the ability to upload critical documents securely, into a platform that allows the owner to grant specific permissions for users to view and share key documents with others.

Financial Monitoring Features

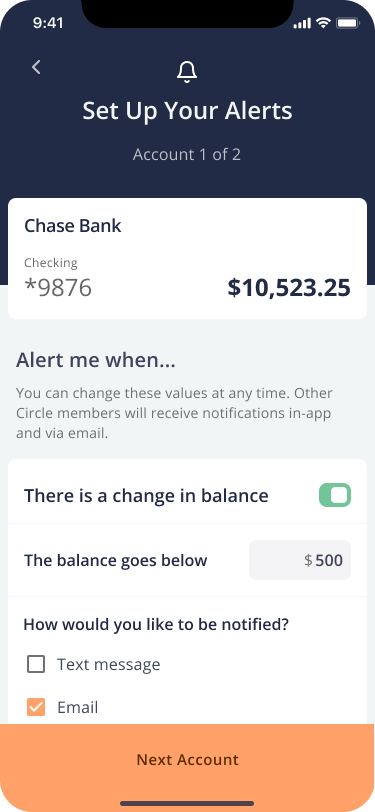

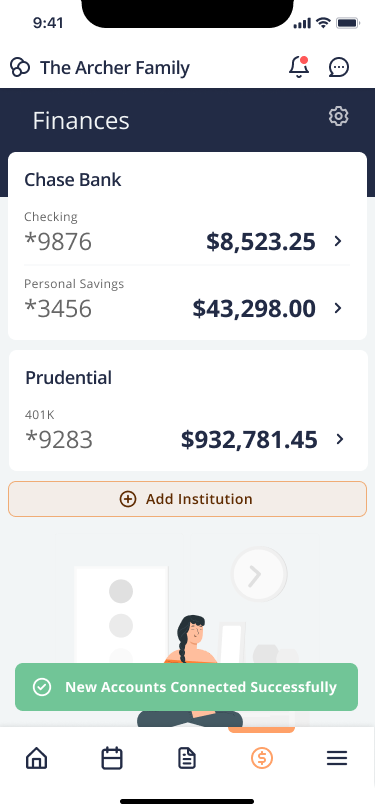

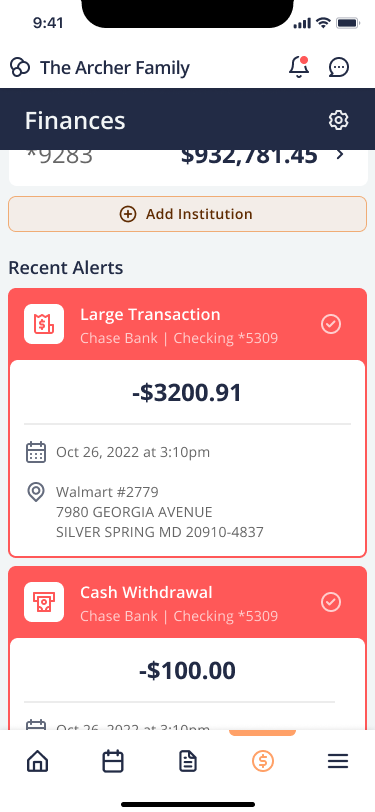

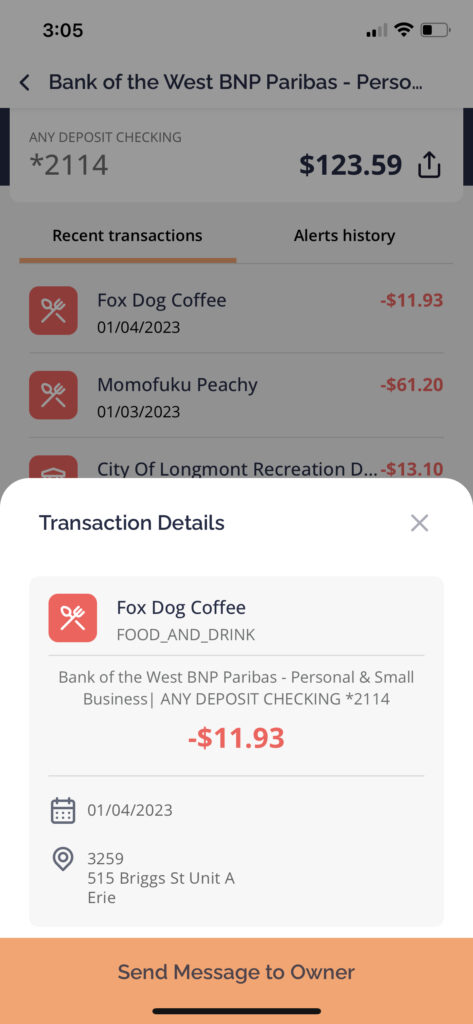

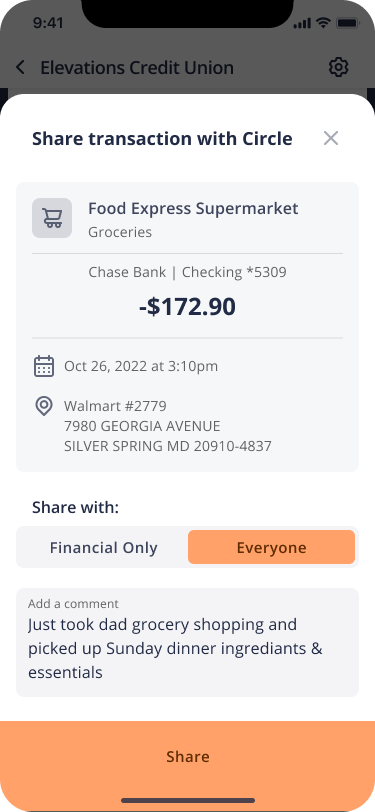

Next up was a mobile and web feature to create transparency around finances for people receiving care.

Research shows that financial literacy scores begin to plummet by approximately 50% after age 65. Statistics also show that most fraud occurs because either people aren’t paying attention to their loved one’s finances – or people think nobody is watching.

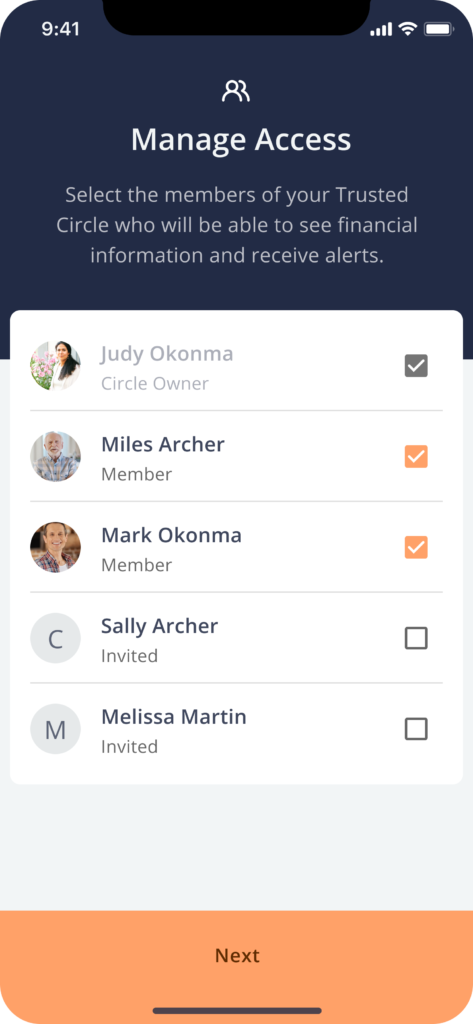

We were working to increase financial durability and independence by leveraging open banking services to aggregate multiple accounts into one simple dashboard. We then added intelligent alerts, offering caregivers the ability to share only the most essential information and take action against potential fraud.